Payroll

Overview

Pay your US-based employees on time, every time.

BambooHR Payroll is the whole enchilada! From easy-to-understand pay stubs to seamless payroll runs and reporting, everything works scrumptiously together to give payroll admins and employees happier paydays. And with our award-winning team, you can switch to BambooHR Payroll without breaking a sweat, and get ongoing, expert support exactly when you need it.

Double data entry? Not on our watch.

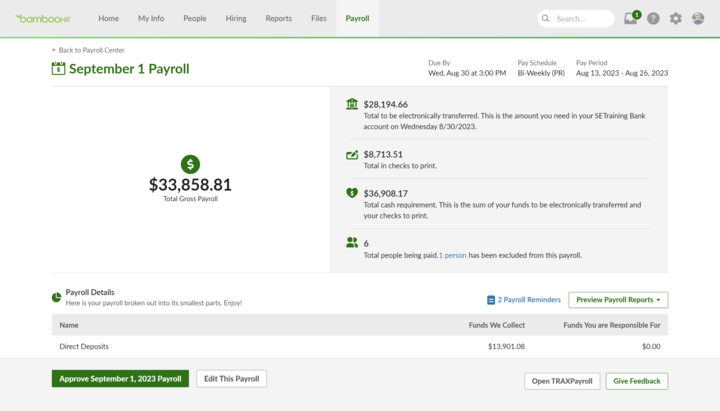

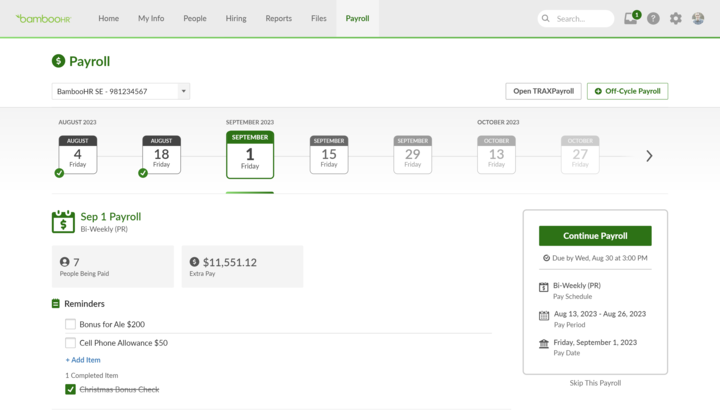

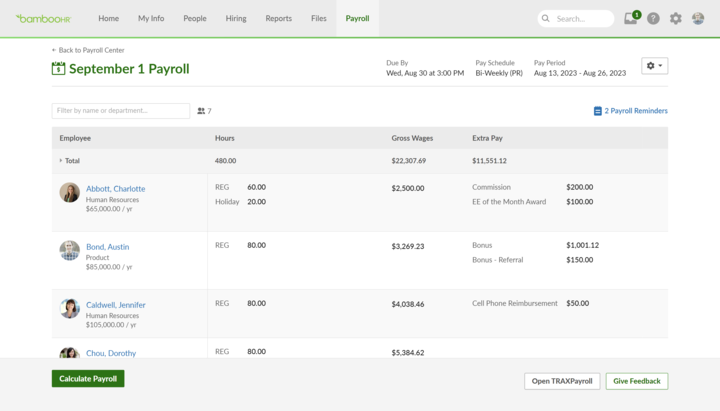

Everything works together in BambooHR to give you a clear, streamlined experience across all your HR tasks. A single source of data means time tracking, time off, and benefits info all flow directly into Payroll—automatically. No double data entry required.

Leave the tax filing to us.

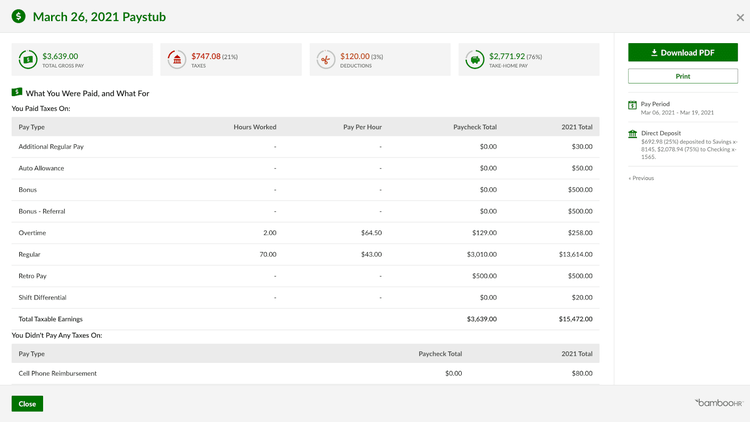

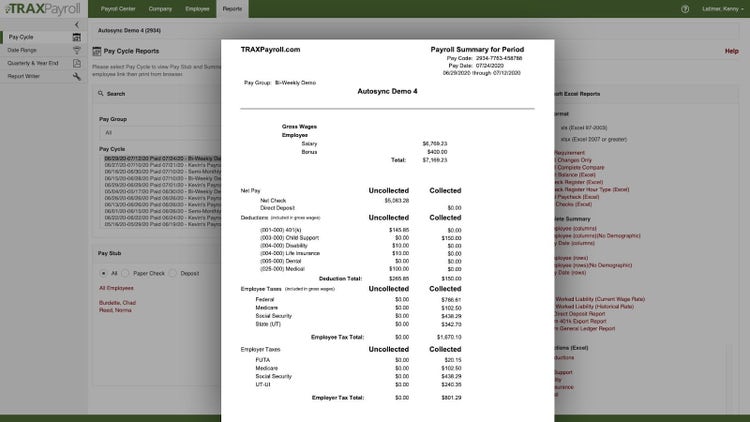

Nothing beats peace of mind, especially during tax season. We take care of all federal, state, and local taxes for your US-based workers—no more forgotten forms, miscalculations, or expensive penalties. Just easy, accurate, and fully compliant tax filings from here on out.

The reports you need, when you need them.

Whether you’re looking to evaluate cash requirements, assess total deductions, or analyze a complete payroll summary per employee, BambooHR helps you make smart, data-informed decisions with instant access to dozens of standard reports. You can also set various access levels, empowering other leaders with people data.

Employee self-service sets HR free.

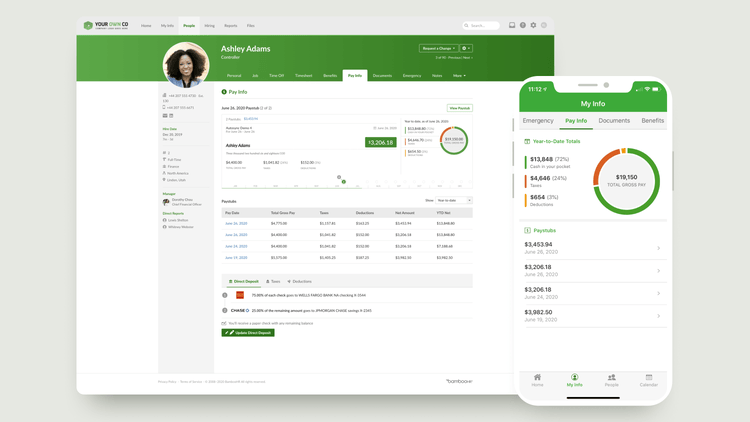

As a people-first HR platform, BambooHR prioritizes employees’ user experience alongside yours. When your employees can easily find pay stubs and edit information like withholdings and direct deposit right in their BambooHR profile or the mobile app, that means fewer shoulder taps for you and a better experience for everyone. And with all that saved time, you can focus on more strategic tasks.

Make the no-sweat switch to BambooHR.

We take the pain out of switching payroll providers. Switching takes less than 4 weeks for most new accounts, and a dedicated implementation specialist is with you every step of the way to ensure you hit the ground running without missing a beat—or a pay period.

Support like this is a game-changer.

Our goal is to set a new bar for the level of care, attention, and expertise you can expect from a support team. Our award-winning payroll support team is here when you need us—one on one and human to human.

Data security you can trust.

Our top priority is keeping your data private and protected. With BambooHR, important security measures like a SOC II audit report, three-tier backup redundancy plan, advanced data encryption, continuous monitoring, and diversified data centers keep your payroll data safe and sound.

Integration

Information in BambooHR like wages, hours, account numbers, benefits, deductions, and withholdings automatically flows into payroll, so you can skip the double-entry and feel confident your data is up to date.

Publisher

BambooHR

Updated: 08/02/2023

Phone Support:

1-888-707-7442 (toll free)

1-385-273-7442 (local)

Email Support:

Support Hours:

7:00AM - 5:00PM PT

Monday - Friday