ACA Reporting Service

Discount Packaging

BambooHR Customer Exclusive Offer:

In addition to our data integration (which is a fantastic value and time saver in-of-itself), we offer an instant 10% discount to current customers on the BambooHR platform. The discount is applied to an ACA reporting package using the code: BambooHR at checkout.

Use code: BambooHR at acareportingservice.com or mention it when speaking to a member of our team.

Overview

Our ACA reporting experience is unmatched in the industry

ACA Reporting Service is the original and #1 trusted full-service reporting solution. As a BambooHR partner, we’ve been vetted as a vendor meeting the highest standards of service excellence. Featuring a custom software and backed by highly trained account managers, we work very hard to deliver great customer experiences. We start with upfront communication from our team about package options, pricing and data requirements. Then we follow through with digital form delivery and electronic filing to the IRS. Our platform is flexible enough to accommodate any type of employer and we have successfully filed millions of forms with the IRS, with a 100% accepted status rate.

Does ACA compliance apply to your company?

The employer mandate portion of the ACA requires that an Applicable Large Employer (ALE) complete the reporting process. Whether an employer is an ALE is determined each calendar year, and generally depends on the average size of an employer’s workforce during the prior year. If an employer has at least 50 full-time employees, including full-time equivalent employees, on average during the prior year, the employer is an ALE for the current calendar year, and is, therefore, is subject to compliance with the ACA. If your company is hovering around the 50-employee mark and needs help determining ALE status, please just give us a call. Important note, employers with self-funded health plans who are not an ALE (less than 50 employees) are subject to filing a Form 1095B (proof of healthcare coverage) and action is required.

What type of employers do we service?

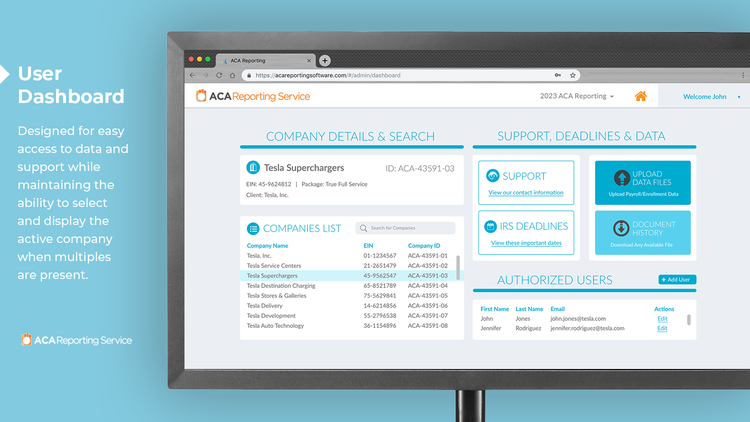

We work with employers of all sizes including companies with multiple EINs that must aggregate the filings. Our customers find tremendous value in our Done For You package option (called True Full Service) that includes a dedicated account manager. And for the experienced, ACA-savvy folks, we offer a lower cost option letting you access our online platform in a self-service experience (reserved for single EIN employers only).

Why not complete the ACA forms on your own?

A few of you reading this just laughed out loud… or cried because you’ve been there, done that. There is nothing stopping any employer from tackling this beast on their own, but, we’d really encourage you to spend a few hundred hours mulling over the IRS regulations and reading the potential penalty section. From our many conversations and from the experience of working closely with customers, here are a few challenges employers can run up against:

- Determining and assigning proper codes and amounts for Lines 14, 15, 16 on Form 1095C.

- Access to trained ACA support professionals that know what questions to ask to address your company’s compliance needs.

- Electronically transmitting the 1094/1095 data to IRS, using their system and their required filing formats.

Keeping it simple, what do we need from you?

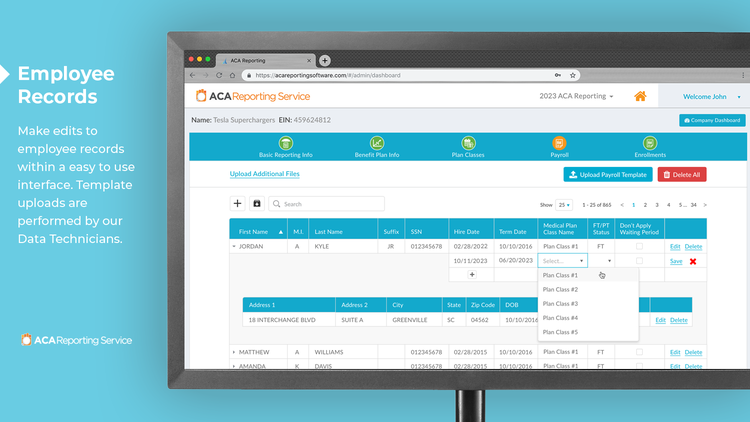

We have invested heavily into our system that relies on two basic employee reports and a simple set of questions about the company’s benefits offering to generate very accurate ACA forms. BambooHR customers uniquely benefit from our partnership as most of the required employee data is extracted by our team automatically and populated into your ACA reporting software account.

The most from the least, who’s doing the work?

Our Done For You True Full Service reporting package is designed to allow our team to do MOST of the work and require the LEAST amount of your time.

We –

- Assist in package selection

- Establish timelines

- Schedule calls

- Provide data requirements

- Setup & manage the account

- Consult with you

- Manipulate the data

- Ask smart questions

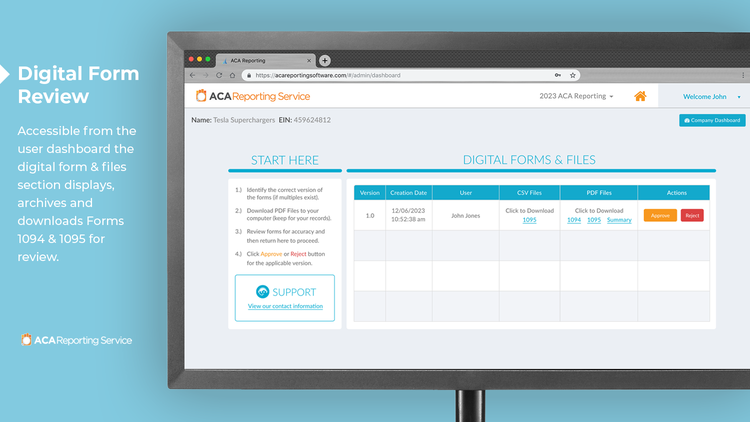

- Audit the forms*

- Offer add-on services including printing & mailing of forms and state filing

- File with the IRS

You –

- Sign up for our service

- Supply the minimally required information

- Help us help you when needed

- Review & Approve the forms

*Every Form 1095c is reviewed by a member of our data team prior to being released to the client. This review has proven essential to maintaining a high level of form accuracy.

Deadlines & Timelines for 2023 tax year

The IRS proposed an extended deadline for employers to furnish Form 1095-C to employees by 30 days after January 31st for each year. Please note the CA FTB adheres to the original deadline.

- January 31, 2024 – Furnish Form 1095-C to Employees (CA residents only)

- March 1, 2024 – Furnish Form 1095-C to Employees

- March 31, 2024 – Electronic filing with IRS

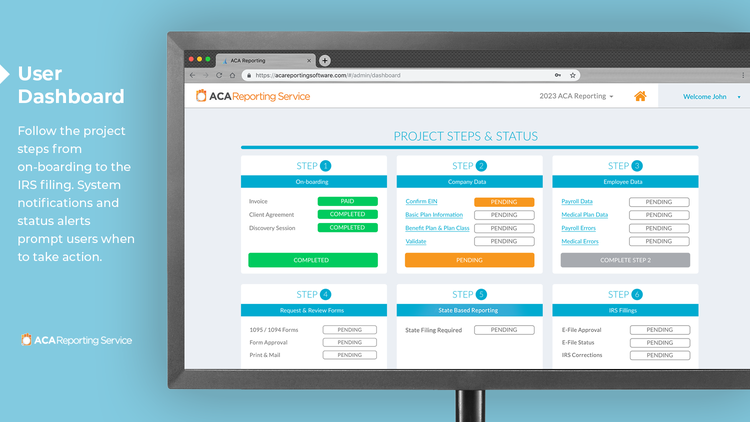

This provides a window of time starting in early-January to work through the ACA form process and make final approvals. In working with the team at BambooHR, customer data is prepped and delivered to ACA Reporting Service at the beginning of January. Medical plan enrollment census reports can be sent to us securely through your online account as early as December.

- December 1, 2023 – For all paid customers, Onboarding begins

- December 1, 2023 – BambooHR customers can submit data reports to ACARS

- January 7, 2024 – ACARS begins receiving employee records from BambooHR

- January 10, 2024 – Step 3 (from online account dashboard) data starts populating

- January 10, 2024 – Step 4 ACA form approval notifications begin

- January 10, 2024 – Step 5 Print & Mail approvals begin

- January 31, 2024 – Deadline to Furnish Form 1095-C to Employees for California residents

- March 2, 2024 – Deadline to Furnish Form 1095-C to Employees

- March 3, 2024 – Step 6 Efile approvals begin

- March 8, 2024 – ACA Reporting Service begins electronically filing to the IRS

Integration

How it works.

Customers initiate a connection using their ACA account in a simple one step process. Once the sync is established the team at ACA reporting service will populate employee records into the ACA account. This is available for all customers using BambooHR's Advantage plan.

Please note: Essentials customers will need to upgrade their plan to access custom reports and utilize the API.

What Data Syncs?

Publisher

ACA Reporting Service

Updated: 12/07/2023

Phone Support:

888-978-8310

Email Support:

Support Hours:

Monday through Friday

8:30am - 5:00pm EST